Mobile recommendations: market overview and outlook

- SlashData Team

- Dec 13, 2009

- 3 min read

[We ‘ve all come to expect ‘people who bought this also bought that’ from online retailers. But the technology is increasingly being adopted in mobile, whether it’s App Stores, media storefronts or operator CRM programmes. Research Director Andreas Constantinou analyses the market of recommendation solutions, the key vendors and casts an eye on the future of recommendations in mobile.]

The market of recommendations solutions is one of the most underhyped in the mobile industry. What started as ‘people who bought this also bought that’ has found its way into 10s of operator portals, not to mention 1,000s of mobile websites – but has seen very little analysis in mainstream media.

Recommendations are also the differentiator (the cherry on the cake) for today’s App Stores – see earlier analysis of the App Store 2-year future. This has prompted several mobile operators (including Vodafone, O2 Telefonica and T-Mobile) to issue RFIs/RFQs in 2009. In parallel to the rising commercial adoption, the research interest has also surged, with the Recommender Systems 09 conference gathering 50% more paper submissions than last year from 35 countries – making this a rare case of synchronicity between commercial and academic worlds. The recommendations market is just emerging into the mainstream industry radar while so much vendor and operator activity has been going on behind the scenes.

Recommendation solutions are appearing in a number of different forms: – Mobile Portal Personalization: adaptation of navigational elements, content listed, ads served and personalised search results (e.g. Changing Worlds, Choice Stream, Media Unbound and Leiki) – Content Discovery and Recommendations: pure content discovery and recommendations across content types (e.g. Xiam, FAST) – Subscriber segment targeting: user profiling and segmentation as part of an online marketing campaign (e.g. Coremetrics and Pontis) – Influencer targeting: profiling and identification of influential subscribers (e.g. Xtract and Strands) – Mobile advertising solutions: inventory targeting (e.g. Jumptap, Aggregate Knowledge, Velti/Ad Infuse, Medio and Wunderloop) – Web (non-mobile) Product/Content Personalization: cross-channel product and content recommendations optimised for retailers, web and media (e.g. ChoiceStream, Loomia, Aggregate Knowledge) – Business analytics: product/offer bundle recommendations based on user segmentation and real-time behaviour analysis (e.g. Olista, Oracle, ThinkAnalytics and Coremetrics)

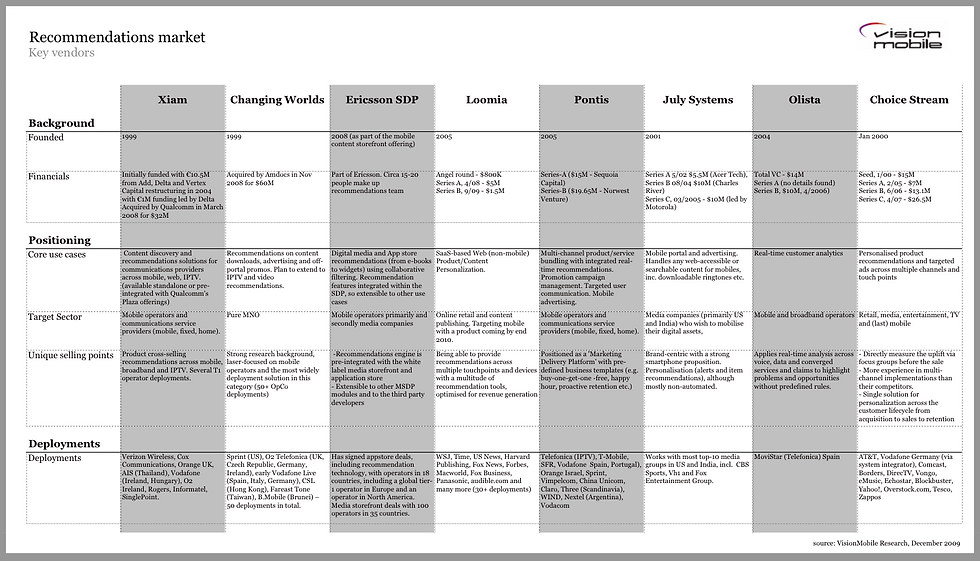

We ‘ve spoken to several vendors of recommendation solutions, focusing on those closer to the mobile industry. What’s most interesting in comparing and contrasting solutions is the target customer, use cases addressed and unique selling points and how these differ across vendors. The next table summarises our findings from researching eight key vendors in the recommendations market: Xiam, Changing Worlds, Ericsson, Loomia, Pontis, July Systems, Olista and Choice Stream. This is only a subset of the circa 40 vendors who offer some form of recommendation solution, whether pre-integrated into a vertical form (e.g. App Store) towards operators or offered horizontally across multiple touch points (e.g. mobile, broadband, web, retail) towards media brands.

(click to enlarge)

So what’s next? In the mobile domain operators are integrating recommendations into App Stores, but will be moving to business analytics, advanced CRM and product/service recommendations during 2010-11. We don’t see recommendations as applicable to multiple touch points (e.g. mobile AND broadband) just yet, as recommendation engines need to be highly optimised and continuously tuned to the channel and content type in question.

The sophistication of recommendation engines needed firstly for live clickstream processing and secondly for content-specificity implies that the incumbent value-added service and SDP vendors will need to buy in (rather than build) technology. We expect this will lead to M&As thanks to the abundant technology startups out there. Clearly an interesting space to watch in 2010.

Comments welcome as always.

– Andreas follow me on twitter: @andreascon